One could find it challenging to keep up with the developments in the high-tech world where disruptive ideas are always being introduced to humanity. However, consumers should adopt new technical items if they promise high returns in order to stay competitive.

This is especially true in stock trading, which is revolutionizing due to technological improvements, evolving quickly, and becoming more accessible to large numbers of consumers.

Because of its unmatched computing powers and intelligent decision-making abilities based on vast information sets, the application of AI in stock trading has opened new potentials for maximizing trade profits more quickly than conventional methodologies could possibly deliver.

This blog will help you understand the AI stock trading concepts along with its advantages and disadvantages. It offers helpful advice for non-technical people who want to benefit from these innovations.

Understanding AI stock trading

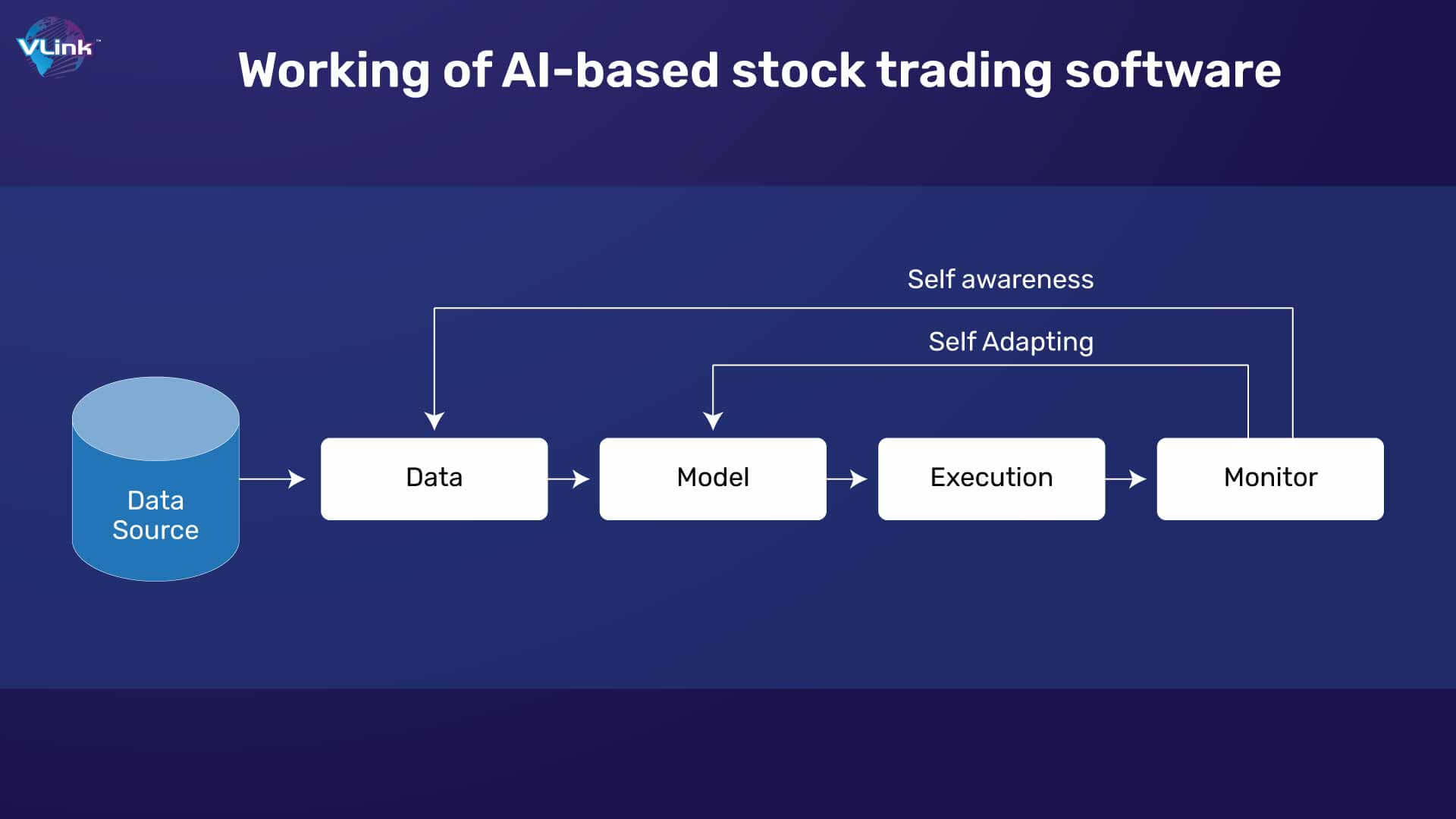

AI stock trading uses machine learning and artificial intelligence to assess market data, historical trends, and related factors in real time. AI systems may find trends and forecast market moves by quickly and precisely digesting this information.

But that's only the start. A key advantage in today's fast-paced markets is the ability to execute transactions with unprecedented speed and accuracy thanks to the usage of AI for stock research, trade discovery, and execution.

To understand the financial industry, use data to determine price changes, identify reasons of shifts in prices, conduct sales and trades, while maintaining focus on the constantly shifting market, AI trading firms use a variety of tools, including predictive analysis, implementation of AI algorithms and upgrade traditional platforms.

There are basically four types of AI trading:

- Quantitative modeling is used in quantitative trading, sometimes known as "quant trading," to examine the price and volume of stocks and transactions and determine the most profitable investment possibilities.

- Stock traders that employ a set of predetermined rules based on previous data to make trading choices are said to be engaging in algorithmic trading, commonly referred to as "algo-trading."

- High-frequency trading, a sort of algorithmic trading, is characterized by the fast purchase and sale of enormous numbers of stocks and shares.

- Automated trading is the process of creating a trading system employing the technical analysis of quantitative trading in conjunction with automated algorithms created from historical data.

When trading stocks using artificial intelligence (AI), sophisticated algorithms and machine learning techniques are used to examine enormous volumes of financial data and make wise trading decisions.

Also Read: How To Build Custom Financial Software For Your Business

Roles of AI in stock trading

To optimize trading techniques and maybe generate higher profits, the objective is to discover patterns, trends, and anomalies in the market. Here are the key roles that AI plays in stock trading:

1- Data gathering: The first phase is gathering significant financial data from a variety of sources, including sentiment on social media, news stories, corporate financials, historical pricing data, and more. Both organized (such as numerical) and unstructured (such as text) data can be found in this set.

2- Data preprocessing is preparing the obtained data for analysis by cleaning, normalizing, and transforming it. To assure the accuracy of the data required to train AI models, preprocessing includes managing missing values, scaling data, and reducing noise.

3- Feature engineering: After preprocessing, pertinent features or indications with potential predictive value are identified from the data via feature engineering. The process of feature engineering includes choosing and developing pertinent measures, such as sentiment ratings, price-to-earnings ratios, or moving averages.

4- Algorithm selection: Choosing the relevant algorithm for accurate stock trading. They include:

Machine learning models: For classification and regression problems, supervised learning models like decision trees, support vector machines, or neural networks can be utilized.

Reinforcement Learning: With this strategy, agents are taught to base their decisions on feedback they get from the market. Its capacity to change with the needs of the marketplace has helped it become more well-liked.

Natural Language Processing (NLP): NLP techniques may be used to evaluate social media data and news sentiment to determine how the public is feeling and how it can affect stock prices.

5- Training the model: Using historical data, the AI models are trained so that the algorithm can recognize patterns and connections in the data. To create forecasts, the models attempt to represent the underlying market dynamics.

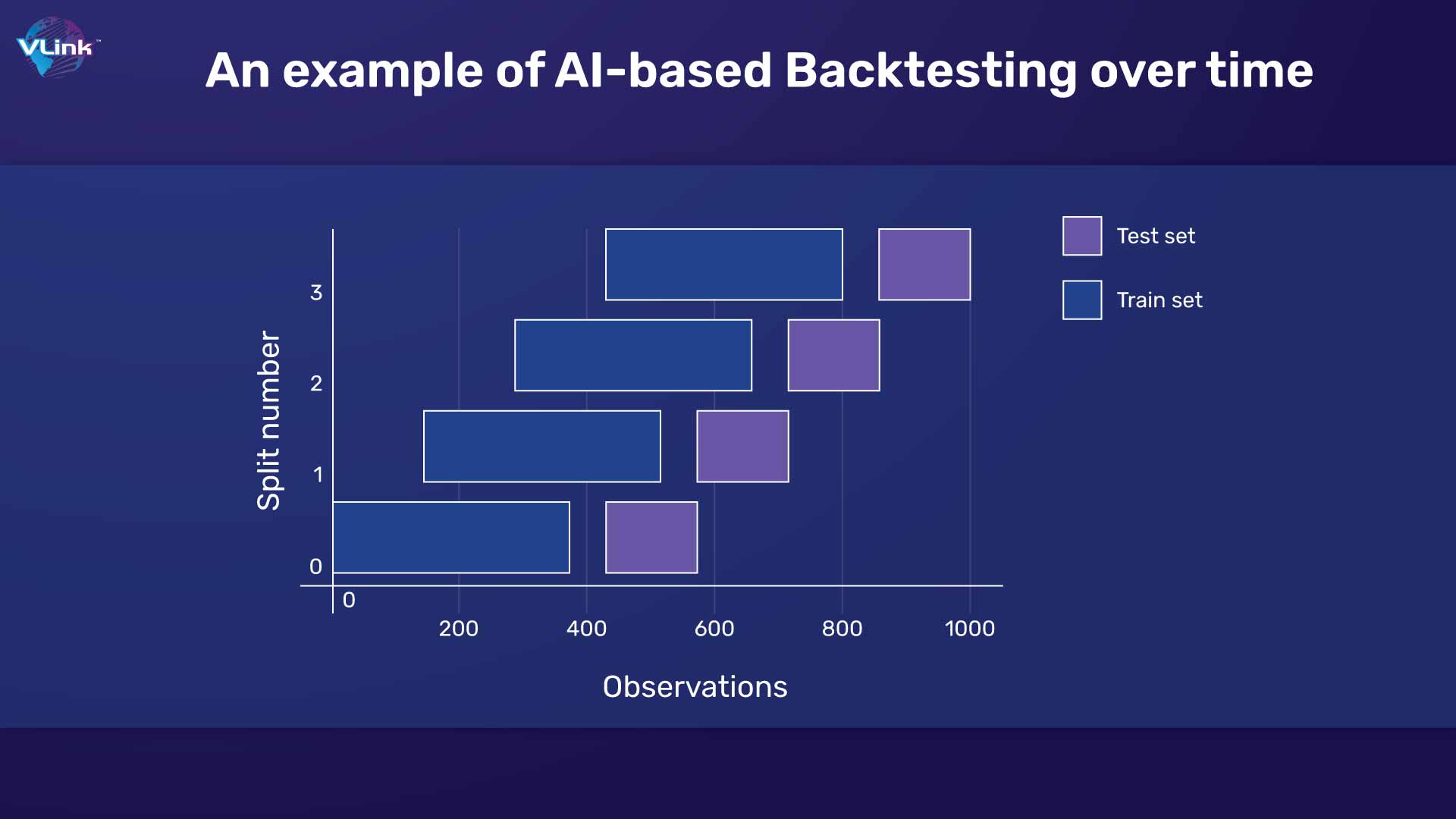

6- Backtesting: After the models are trained, their performance is assessed by testing them on archival data. Backtesting offers insights into prospective future performance and aids in evaluating how well the AI system might have done in the past.  7- Live trading: The AI model may be used for live trading following a successful backtest. It keeps track of real-time data, develops forecasts, and places trades in accordance with predetermined strategies or criteria. It's crucial to have risk management procedures in place to guard against big losses brought on by unforeseen market activity.

7- Live trading: The AI model may be used for live trading following a successful backtest. It keeps track of real-time data, develops forecasts, and places trades in accordance with predetermined strategies or criteria. It's crucial to have risk management procedures in place to guard against big losses brought on by unforeseen market activity.

8- Continuous optimization: Industries are volatile and always evolving, therefore learning and adapting must be ongoing. In order to stay current and productive, successful AI stock trading systems continually learn from fresh data and modify their techniques.

Benefits of AI in stock trading

The implementation of AI in stock trading can gather diverse textual and linguistic elements by utilizing sentiment analysis to find trends in objective information. By scanning news sources and social media sites, AI stock trading system solutions may identify specific market swings and variations.

Technical analysts can analyze enormous volumes of historical and real-time market data to spot patterns, trends, and possible trading opportunities using AI algorithms and machine learning approaches.

By comparing current deals to past trade behavior, AI may be used to spot abnormalities. This is a productive technique to reduce potential risks and mistakes. Continuous monitoring enables accurate performance tracking by spotting any errors made by the algorithm and fixing them as they happen.

Poor trading judgments can also result from cognitive biases, exhaustion, and emotional decision-making. Because they base their judgments on an objective study of the facts rather than being swayed by emotions or subjective biases, AI-driven systems lower the risk associated with these elements and generally result in more sensible trading decisions.

Being considered among the top tech trends of future, AI is considerably more capable than just looking at numbers. It can interpret financial statements that are based on language, social media mood, news coverage of economic indicators, and even more obscure sorts of data. Your investing research process is streamlined and made simpler by all of this study.

Additionally, AI can search the NASDAQ and NYSE to assess specific AI equities, like MSFT, NVDA, PLTR, GOOGL, and even ETFs with an AI emphasis. It may encourage the trading of artificial intelligence equities at profitable prices.

One of the most crucial traits for traders is the capacity for making judgments quickly and accurately. AI can speed up decision-making, allowing it to possibly profit from market opportunities before human traders can respond.

AI may also automate trade execution, minimizing the need for human intervention and freeing up time for research and plan evaluation. Additionally, AI has the capacity to develop into a totally independent system.

AI stock trading vs regular stock trading

Regular stock trading and AI stock trading are separate strategies, each with its own advantages and disadvantages. Think about the following elements:

- Decision-making with precision & speed

Large volumes of data are processed by AI-driven systems. Like this, trading bots carry out deals at breakneck speed, guaranteeing speedier and more precise selections. Blind spots and cognitive biases are frequently introduced during routine stock trading and manual decision-making, which can cause slower execution and mistakes.

- Discipline & consistency

Even in the most unpredictable market situations, algorithms maintain a disciplined approach by continually following predefined criteria. On the other hand, human traders are prone to veering from their predetermined tactics due to emotion.

- Automation & productivity

The fact that algorithms don't need to rest or take breaks enables continuous monitoring and quick trade execution. The need for relaxation, rehabilitation, and downtime forces human traders to restrict their attention as they actively monitor the stock market.

- Data analysis & processing

Human traders sometimes overlook or completely ignore trends that AI can quickly spot by analyzing large amounts of previous data. The amount of data that a human can handle manually and the amount of time an analyst has are the two main constraints on manual analysis.

- Risk management

AI algorithms for risk management may enforce tight risk management guidelines, reducing possible losses. Due to uncertainty or supervision, human traders may have trouble following risk management standards.

- Handling complexities

AI is capable of handling intricate, sophisticated strategies with extreme precision. When manually creating and implementing sophisticated strategies, a trader needs to put in significant work and study.

How VLink can help you integrate AI in stock trading apps?

Artificial intelligence (AI) for stock trading promises simplified efficiency, cost savings, and forecasts that are incredibly accurate. But it's important to be aware of the potential risks associated with relying only on AI for stock trading. Equally important is maintaining a healthy balance between AI technology and human judgment.

A well-known AI software development business, VLink focuses on creating tailored AI products for the financial industry. We provide feature rich FinTech software that will assist you in maximizing value for both you and your clients.

Shivisha Patel

Shivisha Patel