The Middle East stands at a defining crossroads. A region historically synonymous with oil production is now emerging as the world's most ambitious testing ground for AI-powered climate solutions. This transformation is not incremental—it is a strategic reinvention backed by sovereign wealth, regulatory mandates, and industrial-scale infrastructure that few other markets can match.

Yet the real opportunity is not in software alone. It lies in industrial-grade AI applications—systems that optimize water desalination, stabilize renewable energy grids, and drive carbon capture efficiency. The UAE and Saudi Arabia possess the capital, the regulatory frameworks, and the sandbox environments to deploy these technologies at scales Western markets cannot yet support.

Organizations seeking to capitalize on this shift are increasingly turning to specialized AI development services that combine deep learning expertise with domain knowledge in energy, utilities, and environmental systems. This article unpacks where the $2.4 billion climate-AI opportunity originates, which use cases are gaining traction, and how enterprises, startups, and investors can position themselves to capture value in this rapidly evolving landscape.

Why the Middle East Is Becoming the World's Climate-AI Testbed

From Hydrocarbons to "Green AI": A Regional Inflection Point

Critically, the Middle East is moving from importing climate tech to co-developing it. Partnerships between regional entities and global technology providers are creating localized AI solutions trained on Middle Eastern environmental data—sandstorms, extreme heat, and water salinity—rather than generic global models. The development of sovereign AI models like Jais and Falcon demonstrates this commitment to regional technological self-sufficiency.

Why UAE & Saudi Arabia Can Scale Climate AI Faster Than the West

Three structural advantages distinguish the region. First, centralized decision-making accelerates deployment timelines. When ADNOC deploys 30 AI tools for predictive maintenance and energy efficiency, the decision moves from concept to execution without the regulatory fragmentation common in Western markets.

Second, sovereign wealth funds provide patient capital that commercial investors cannot match. Projects with 10-year payback horizons—typical for industrial climate tech—align with the investment mandates of funds like Mubadala and the Public Investment Fund. This capital availability enables infrastructure-scale deployments that venture-backed companies in other markets cannot finance.

Market Sizing: Where the USD 2.4B Climate-AI Opportunity Comes From

Energy & Utilities: Grid Optimization and Predictive Maintenance

The energy sector represents the largest addressable market. Saudi Arabia targets 130 GW of renewable capacity by 2030, up from less than 5 GW currently. Integrating this intermittent capacity into the existing grid requires AI-driven load balancing, demand forecasting, and storage optimization. The scale of this transformation creates demand for sophisticated enterprise AI solutions that can operate reliably in extreme conditions.

ADNOC's deployment demonstrates the value at stake. In 2023 alone, the company reported generating $500 million in value through AI-enabled predictive maintenance and energy efficiency—while reducing CO2 emissions by over one million tons between 2022 and 2023. These are not pilot results; they are enterprise-scale outcomes validated across operational environments.

Green data centers represent an emerging asset class with immediate capital requirements. As compute demand grows exponentially—driven by AI workloads themselves—the need for sustainable cooling solutions intensifies. Immersion cooling systems managed by AI algorithms can reduce energy consumption by 40-50% compared to traditional air cooling, creating significant opportunities for technology providers and facility operators.

Water & Desalination: AI for Efficiency in Arid Environments

Water scarcity is not a future concern in the Gulf—it is an operational reality. The region depends on desalination for over 90% of its potable water, and these facilities are among the most energy-intensive industrial operations globally. AI optimization of reverse osmosis processes can reduce energy consumption by 15-25%, translating directly to lower emissions and operating costs.

Leak detection presents another high-value application. Water distribution networks in arid climates lose significant volumes to infrastructure failures. AI-powered monitoring systems identify anomalies before they escalate, protecting both water resources and capital assets. Organizations implementing IoT and data analytics solutions for water infrastructure report detection rates 10-20x higher than manual inspection methods.

The water-energy nexus creates compounding optimization opportunities. Desalination facilities powered by renewable energy, with AI managing both the energy supply and the desalination process, can achieve carbon-neutral water production. Pilot projects in the UAE are demonstrating this integrated approach, with results that point toward regional scalability.

Mobility, Logistics & Smart Cities: Emissions Reduction at Scale

Urban emissions in the Gulf are concentrated in transportation and logistics. AI route optimization—already deployed by regional players like Talabat—reduces fuel consumption across delivery fleets. When applied to public transit, freight networks, and autonomous mobility systems, the aggregate impact on emissions becomes substantial.

Smart city initiatives like NEOM integrate AI across transportation, building management, and resource allocation. These projects serve as proving grounds for technologies that can subsequently scale to established urban centers across the region. The digital transformation of urban infrastructure creates demand for integrated platforms that coordinate multiple systems simultaneously.

Electric vehicle adoption is accelerating across the Gulf, driven by both environmental commitments and declining battery costs. AI-powered charging infrastructure optimization ensures grid stability while maximizing renewable energy utilization for EV charging. This application demonstrates how climate-AI solutions often address multiple objectives simultaneously—grid stability, emissions reduction, and consumer convenience.

Climate-AI Market Opportunity by Sector

| Sector | Primary AI Application | Value Driver | Timeline to ROI |

| Energy & Utilities | Grid balancing, predictive maintenance | Cost reduction, emission cuts | 6-18 months |

| Water & Desalination | RO optimization, leak detection | Energy savings, resource protection | 12-24 months |

| Mobility & Logistics | Route optimization, fleet management | Fuel reduction, operational efficiency | 3-12 months |

| Oil & Gas | Flaring reduction, process optimization | Carbon reduction, regulatory compliance | 6-18 months |

| Agriculture | Smart irrigation, yield prediction | Water conservation, food security | 6-12 months |

Core Use Cases: How AI Solutions for Climate Change Are Deployed in Practice

AI for Energy Efficiency & Renewable Grid Balancing

Renewable energy intermittency is the central challenge of grid decarbonization. Solar output fluctuates with cloud cover, sandstorms, and dust accumulation. AI forecasting models predict these variations hours or days in advance, enabling grid operators to optimize storage dispatch and minimize reliance on fossil fuel backup.

Beyond forecasting, AI systems optimize energy consumption across industrial facilities in real time. Machine learning algorithms analyze production schedules, equipment loads, and external conditions to reduce energy waste without compromising output. Organizations implementing specialized AI development services for energy systems typically report measurable efficiency gains within the first operating quarter.

The integration of AI with existing SCADA and building management systems enables non-disruptive deployment. Rather than replacing legacy infrastructure, AI layers add intelligence to existing control systems—monitoring performance, identifying optimization opportunities, and executing adjustments automatically or through operator-approved recommendations.

AI for Water Management & Desalination Optimization

Desalination plants consume approximately 3-4 kWh per cubic meter of water produced. AI optimization of membrane fouling prediction, pressure calibration, and energy recovery systems can reduce this figure by 15-20%. At regional scale, the energy savings translate to hundreds of thousands of tons in avoided CO2 emissions annually.

Smart irrigation represents an adjacent opportunity. Agricultural operations in the Gulf face extreme water constraints. AI-driven systems that optimize irrigation timing and volume based on soil moisture, weather forecasts, and crop requirements can reduce water consumption by 30-40% while maintaining or improving yields. These systems integrate satellite imagery, ground-based sensors, and meteorological data to provide field-level recommendations.

Aquifer management presents longer-term applications. AI models that predict groundwater depletion patterns and optimize extraction rates help protect water resources that take decades or centuries to replenish. While these applications have longer payback periods, they address existential risks that policymakers increasingly prioritize.

AI in Agriculture & Climate Resilience

Climate resilience in agriculture extends beyond water management. AI models predict pest outbreaks, disease spread, and yield variations under changing climate conditions. These predictions enable proactive interventions—adjusting planting schedules, modifying inputs, or reallocating resources—that protect food security while reducing resource waste.

The UAE has announced initiatives to deploy AI in supporting millions of farmers across climate-vulnerable regions. These programs combine satellite imagery, ground sensors, and weather data to provide actionable guidance at scales previously impossible. The integration of computer vision and predictive analytics enables automated crop health monitoring that would require armies of agronomists to achieve manually.

Vertical farming and controlled environment agriculture represent high-growth segments where AI delivers immediate value. These facilities depend on precise control of lighting, temperature, humidity, and nutrient delivery—all variables that AI systems optimize more effectively than rule-based automation. Gulf investors are backing multiple vertical farming ventures, creating demand for the AI platforms that make these operations economically viable.

Brown-to-Green Transitions in Oil & Gas

The region's largest climate-AI opportunity may lie in decarbonizing existing hydrocarbon operations. AI-powered systems detect methane leaks, optimize flaring processes, and reduce energy consumption across upstream and downstream operations. These "brown-to-green" applications deliver immediate emissions reductions without requiring infrastructure replacement.

Carbon capture and storage facilities benefit similarly. AI optimization of capture efficiency, compression energy, and injection rates can improve the economics of CCS projects that would otherwise struggle to achieve commercial viability. As carbon pricing mechanisms expand across the Gulf, the value of these optimizations increases correspondingly.

Green hydrogen production—a priority for both UAE and Saudi Arabia—depends on AI optimization to achieve competitive economics. Electrolyzer efficiency, renewable energy matching, and storage optimization all benefit from AI control systems. The region's ambitions to become a major green hydrogen exporter create sustained demand for these capabilities.

Real-World Examples: AI-Driven Climate Tech in UAE and Saudi Arabia

Enterprise Example: ADNOC's AI-Powered Decarbonization

ADNOC's deployment of the NeuTroph AI system demonstrates enterprise-scale climate impact. The system predicts equipment failures across the company's upstream operations, enabling preventive maintenance that reduces unplanned downtime and associated emissions from flaring and inefficient operation.

The quantified results validate the business case: $500 million in value generated during 2023, with over one million tons of CO2 emissions reduced between 2022 and 2023. This is not a pilot program—it is a production deployment across 30+ AI tools that continues to expand. The success has prompted ADNOC to increase AI investment and extend applications to additional operational domains.

The ADNOC case demonstrates a critical principle: AI climate solutions deliver both environmental and financial returns. The $500 million in value creation funds further decarbonization initiatives, creating a virtuous cycle that accelerates transition rather than treating sustainability as a cost center.

Giga-Project Example: Mohammed bin Rashid Al Maktoum Solar Park

The AI deployment extends to operational optimization. Machine learning models forecast solar irradiance and predict dust accumulation on panels, enabling proactive cleaning schedules that maximize energy generation while minimizing water consumption. These capabilities demonstrate how AI enables renewable infrastructure to operate at peak efficiency in challenging desert environments.

The integration of solar generation, battery storage, and data center load creates a complex optimization problem that AI solves continuously. By predicting demand patterns and renewable generation simultaneously, the system minimizes grid imports while ensuring uninterrupted data center operations—a model that other regions are studying for replication.

Startup Example: AI Platforms for Water and Climate Analytics

Regional startups are addressing localized challenges that global platforms overlook. AI-powered IoT platforms for water optimization are gaining traction by integrating data from desalination facilities, distribution networks, and end-user consumption. These platforms leverage cloud computing infrastructure to process data from thousands of sensors in real time.

These platforms benefit from government sandbox programs in NEOM and Masdar City, where regulatory barriers are lower and procurement cycles faster. Successful pilots in these environments establish the credibility required for broader regional deployment. The combination of sovereign support and commercial validation creates pathways to scale that pure venture-backed models cannot replicate.

Climate analytics startups are also emerging to serve the growing ESG reporting market. These platforms aggregate environmental data from multiple sources, apply AI for anomaly detection and trend analysis, and generate compliance-ready reports. As regulatory requirements tighten, demand for these services expands correspondingly.

Decision-Making Frameworks for CXOs and Investors

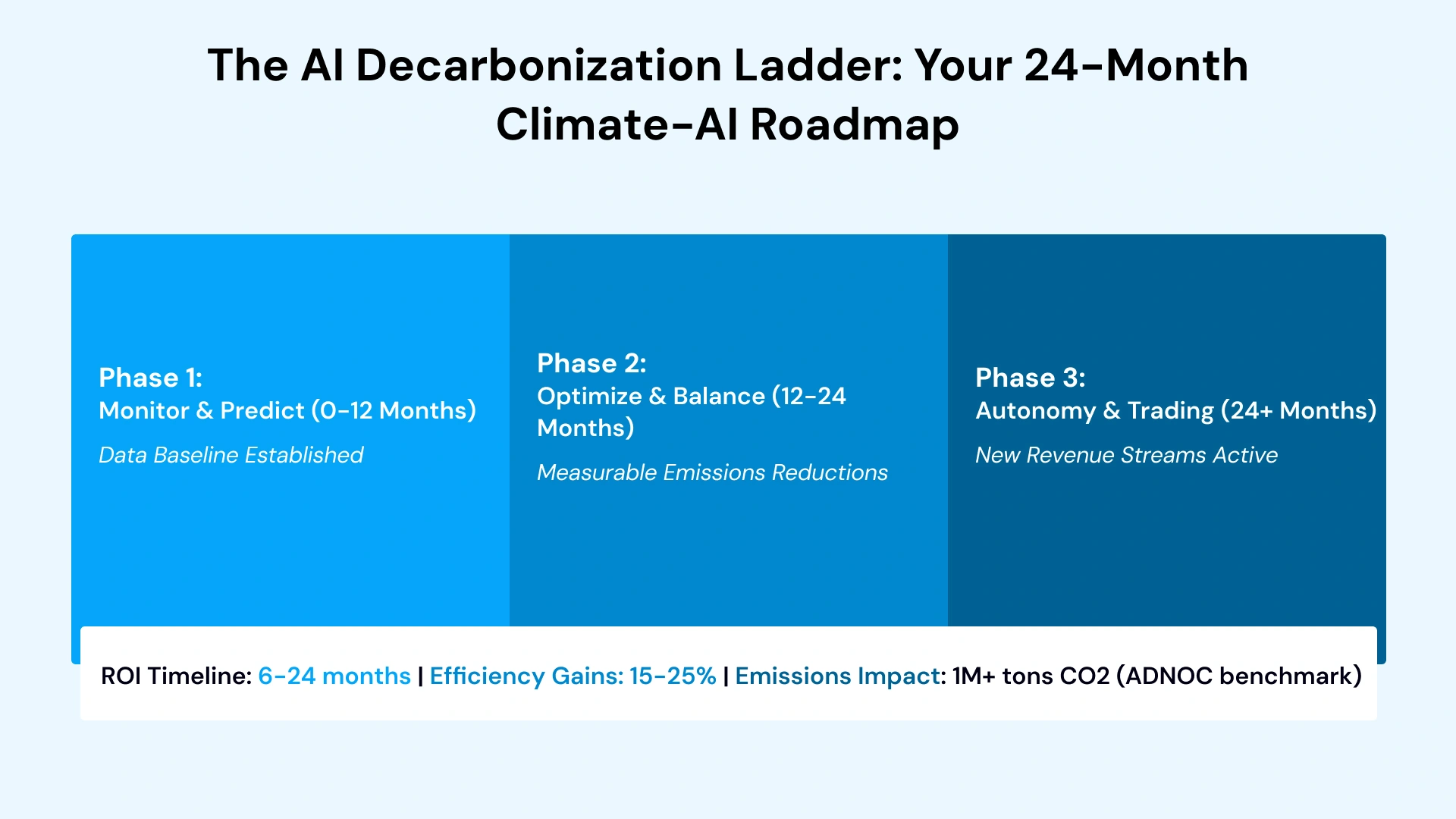

The AI Decarbonization Ladder (Monitor → Optimize → Autonomy)

Corporate innovation and sustainability leaders benefit from a phased approach to AI deployment. The Decarbonization Ladder provides a structured pathway from initial data collection to autonomous operation.

Phase 1: Monitor & Predict (0-12 Months) — Deploy AI sensors on legacy infrastructure to establish data baselines. Implement predictive maintenance to prevent leaks and flaring. Value proposition: High immediate ROI through operational efficiency. This phase typically requires modest capital investment and delivers measurable returns that fund subsequent phases.

Phase 2: Optimize & Balance (12-24 Months) — Implement AI algorithms to balance renewable energy intermittency. Reduce fossil fuel backup usage through intelligent dispatch. Value proposition: Measurable emissions reductions aligned with reporting requirements. This phase builds on Phase 1 data to enable more sophisticated interventions.

Phase 3: Autonomy & Trading (24+ Months) — Deploy autonomous AI agents for real-time carbon credit and energy surplus trading. Value proposition: New revenue streams from sustainability infrastructure. This phase transforms sustainability operations from cost centers to profit contributors.

MENA Climate-AI Due Diligence Model (Sovereignty, Hardware, Alignment)

Investors evaluating climate-AI opportunities in the region require a specialized due diligence framework. Three criteria distinguish high-potential investments from attractive-sounding ventures.

Sovereignty Check — Does the AI model comply with local data residency requirements? Solutions that depend on processing sensitive operational data outside UAE or KSA jurisdictions face regulatory barriers that limit scalability. Sovereign AI models like Jais and Falcon offer compliance advantages.

Hard-Tech Integration — Is the AI purely software, or does it integrate with industrial hardware and IoT infrastructure? Hardware-integrated solutions face higher barriers to entry but command significantly higher value in MENA markets. The region values solutions that demonstrate industrial-grade reliability.

Government Alignment — Is the solution applicable to giga-projects like NEOM, the Red Sea Development, or Masdar City? Government-aligned solutions access procurement channels and validation opportunities unavailable to purely commercial ventures. Alignment with national priorities accelerates market access.

PAA: Common Questions CXOs Ask About AI Climate Solutions

How Is AI Used to Reduce Carbon Emissions in the Middle East?

AI reduces carbon emissions through predictive maintenance, process optimization, and grid balancing. In the Middle East specifically, AI systems detect methane leaks in oil and gas operations, optimize energy consumption in desalination facilities, and balance intermittent renewable energy supplies. ADNOC's deployment reduced over one million tons of CO2 emissions in a single year through AI-enabled operational improvements across 30+ applications.

What Are the Best AI Solutions for Water Scarcity in GCC Countries?

The most effective AI solutions address desalination optimization and distribution efficiency. AI-driven reverse osmosis optimization reduces energy consumption by 15-25%, while leak detection systems protect water infrastructure. Smart irrigation platforms using AI for timing and volume optimization can reduce agricultural water use by 30-40%. These applications align directly with GCC countries' water security priorities and Net Zero commitments.

How Does AI Support Saudi Vision 2030 and UAE Net Zero Goals?

AI serves as an enabling technology across multiple Vision 2030 and Net Zero priorities. In Saudi Arabia, AI supports the target of 130 GW renewable capacity by 2030 through grid optimization. The UAE's AI strategy positions artificial intelligence as central to achieving carbon neutrality by 2050. Both nations invest heavily in AI research infrastructure, with Saudi Arabia allocating $135 billion for digital transformation including AI-driven sustainability initiatives.

What Are the Risks and Limitations of AI in Climate Tech?

Key limitations include data quality dependencies, energy consumption of AI systems themselves, and the need for specialized expertise. AI models trained on non-regional data may not account for Middle Eastern environmental conditions like sandstorms and extreme heat. Implementation risks include overreliance on automation without human oversight and potential for algorithmic bias in resource allocation decisions. Ethical AI frameworks and robust data governance mitigate these concerns.

What Competitors Miss: Funding Gaps, ROI and Ethics

Middle East Climate-Tech Funding Gaps

Despite headline-grabbing sovereign fund commitments, significant funding gaps persist in climate-AI deployment. Early-stage startups face difficulty accessing capital for hardware integration, which requires higher upfront investment than pure software ventures. The mismatch between 10-year project timelines and typical VC fund horizons limits commercial investment in transformative technologies.

Government-backed sandbox programs address this gap partially by providing validation opportunities that de-risk subsequent commercial investment. Strategic partnerships between startups and established regional players like ADNOC and DEWA offer alternative pathways to deployment capital. Corporate venture arms are increasingly active in filling the gap between seed funding and growth capital.

Data Governance & Ethical AI in Sustainability

Ethical AI frameworks are emerging as competitive differentiators. Solutions that address transparency in algorithmic decision-making, bias detection, and accountability structures attract both regulatory support and enterprise adoption. The UAE's development of sovereign AI models like Falcon demonstrates regional commitment to AI systems that align with local values and governance requirements.

Data residency requirements create both challenges and opportunities. Solutions architected for local data processing comply with regulations while often delivering lower latency and more relevant outputs than systems dependent on overseas processing. Organizations implementing robust data governance frameworks gain competitive advantages in enterprise sales cycles.

ESG Reporting, Compliance & AI-Driven Measurement

ESG reporting requirements are tightening across the Gulf. AI-driven measurement systems automate data collection, validation, and reporting for carbon emissions, water usage, and other sustainability metrics. These platforms reduce compliance costs while improving accuracy and auditability.

Forward-looking enterprises are deploying AI not just for compliance but for competitive positioning. Real-time ESG analytics dashboards enable proactive management of sustainability performance, while predictive analytics identify improvement opportunities before they become compliance issues. The integration of ESG data with operational systems creates closed-loop optimization that continuously improves environmental performance.

What This Means for Enterprises, Startups and Investors

For Corporate Innovation & Sustainability Leaders

The window for early-mover advantage in climate-AI deployment is narrowing. Enterprises that establish AI capabilities now will capture efficiency gains and emissions reductions that compound over time. The Decarbonization Ladder provides a structured pathway from initial deployment to autonomous operation.

Prioritize solutions that integrate with existing infrastructure rather than requiring wholesale replacement. Brown-to-green applications deliver immediate value while building organizational capability for more ambitious transformations. Partnering with experienced providers of AI development services accelerates time to deployment while reducing implementation risk.

Build internal AI literacy alongside external partnerships. The most successful deployments combine vendor expertise with internal champions who understand operational context. Training programs that develop AI competencies across sustainability, operations, and IT teams create the cross-functional alignment that large-scale deployments require.

For AI & Climate-Tech Founders

The Middle East offers unique advantages for climate-AI startups willing to adapt to regional requirements. Solutions that incorporate local environmental data—sandstorms, extreme heat, water salinity—outperform generic global models. Hardware integration creates defensible market positions that pure software cannot match.

Sandbox programs in NEOM and Masdar City provide validation pathways unavailable elsewhere. Successful pilots in these environments establish credibility for regional expansion while demonstrating ROI to subsequent investors. Align solution positioning with national priorities—Net Zero, Vision 2030, water security—to access government procurement and partnership opportunities.

Consider hybrid business models that combine technology licensing with implementation services. Regional enterprises often prefer comprehensive solutions over point products. Partnerships with established system integrators can accelerate market access while allowing startups to focus on core technology development.

For Investors & Strategic Partners

The climate-AI opportunity in the Middle East differs structurally from other markets. Patient capital aligned with 10-year horizons captures value that shorter-term investors cannot access. Focus due diligence on sovereignty compliance, hardware integration, and government alignment—the three factors that distinguish scalable ventures from interesting technology.

Green data centers represent the emerging asset class with immediate capital requirements. As Saudi Arabia builds toward 2.2 GW of compute capacity, demand for AI-driven cooling solutions and energy management systems will accelerate. Co-investment alongside sovereign wealth funds provides access to deal flow and validation that independent investment cannot match.

Consider the full value chain when evaluating opportunities. Companies providing enabling infrastructure—sensors, connectivity, data platforms—often capture more value than application-layer solutions. The buildout of climate-AI infrastructure creates multiple investment entry points beyond the headline-grabbing application companies.

Conclusion

The Middle East is not merely adopting climate technology—it is positioning itself as the world's primary laboratory for industrial-scale AI-driven sustainability. The $2.4 billion opportunity encompasses grid optimization, water efficiency, logistics decarbonization, and brown-to-green transitions across the region's dominant hydrocarbon sector.

For enterprises, the imperative is clear: deploy AI capabilities now to capture efficiency gains and emissions reductions that will compound over the coming decade. For startups, the region offers sandbox environments, sovereign capital, and procurement pathways unavailable elsewhere. For investors, the structural advantages of patient capital aligned with national priorities create opportunities that commercial timelines cannot access.

The convergence of AI capability and climate imperative is reshaping the Middle East's economic trajectory. Organizations that position themselves at this intersection will define the region's sustainable future.

Shivisha Patel

Shivisha Patel