In recent years, investment apps have revolutionized how people access, manage, and grow their wealth. Among these, platforms like Lendo are reshaping the alternative lending landscape by directly connecting investors with vetted, creditworthy small and medium-sized enterprises (SMEs). This peer-to-peer financing model not only opens new avenues for passive income but also empowers businesses with much-needed funding, without relying solely on traditional banking systems.

What sets Lendo apart is its dual value proposition: low-barrier entry for investors and quick, streamlined credit access for businesses. Designed for security, transparency, and convenience, apps like Lendo are increasingly viewed as scalable fintech solutions, not just regionally, but globally.

As the demand for such platforms grows, so does the interest in building similar apps. But how much does it cost to build an app like Lendo KSA? The average cost to develop an app like Lendo ranges between SAR 187,500 and SAR 937,500 (approximately $50,000 to $250,000.

In this blog, we break down the critical factors influencing development costs, explore hidden expenses, and provide actionable insights for founders, CTOs, and digital strategists planning to launch a next-generation investment platform.

Lendo at a Glance: What Makes It Work?

Lendo is a Saudi-based investment platform that bridges the funding gap for small and medium-sized enterprises (SMEs) while offering investors a profitable alternative asset class. Functioning as both an investment tool and a business funding platform, Lendo plays a hybrid role that requires careful alignment between compliance, user experience, and financial transparency.

Dual-User Architecture: SMEs & Investors

Lendo’s platform is designed to serve two distinct user groups:

- SMEs (Borrowers): Businesses in need of working capital can submit unpaid invoices and apply for short-term financing. Lendo offers them fast access to funds without going through lengthy bank approval processes.

This dual-sided model means the platform must accommodate both real-time investment flows and loan origination processes, with built-in risk mitigation for both parties.

Key Innovations & Features That Set Lendo Apart

Here are the key features and functionalities that set Lendo apart from its competitors:

- Invoice Financing: Unlike traditional loans, Lendo allows SMEs to get advances against pending invoices, which minimizes risk for both the lender and borrower. The platform vets the invoices before listing them for funding.

- Dynamic Credit Scoring: Lendo uses a proprietary risk assessment engine to analyze borrower profiles and assign credit ratings. These scores guide investor decisions and help automate risk allocation.

- Shariah Compliance: A major differentiator in the GCC market is Lendo’s adherence to Islamic finance principles. The platform avoids interest-based models and ensures all investment terms align with Shariah law, which adds another layer of regulatory and functional complexity.

- Dual Dashboards: The user experience is tailored for both SMEs and investors. Borrowers can track funding status and repayments, while investors monitor ROI, diversification, and payment schedules via intuitive dashboards.

- Auto-Invest Functionality: Investors can enable auto-invest features based on defined criteria such as risk level, duration, or expected returns. This promotes passive investing and improves fund allocation speed.

- Escrow Account Integration: Funds are held in escrow accounts until conditions are met, ensuring transparency and compliance with Saudi Arabian Monetary Authority (SAMA) guidelines and investor protection protocols.

- Regulatory Reporting & Audit Trails: Lendo offers backend capabilities for generating compliance reports and maintaining detailed audit trails, which are essential for fintech governance.

- Customer Support Chatbot: Integrated support with chatbot and live agent escalation ensures user queries are resolved quickly, enhancing the overall experience.

This dual-sided model means the platform must accommodate both real-time investment flows and loan origination processes, with built-in risk mitigation for both parties.

Key Innovations & Features That Set Lendo Apart

Here are the key features and functionalities that set Lendo apart from its competitors:

- Invoice Financing: Unlike traditional loans, Lendo allows SMEs to get advances against pending invoices, which minimizes risk for both the lender and borrower. The platform vets the invoices before listing them for funding.

- Dynamic Credit Scoring: Lendo uses a proprietary risk assessment engine to analyze borrower profiles and assign credit ratings. These scores guide investor decisions and help automate risk allocation.

- Shariah Compliance: A major differentiator in the GCC market is Lendo’s adherence to Islamic finance principles. The platform avoids interest-based models and ensures all investment terms align with Shariah law, which adds another layer of regulatory and functional complexity.

- Dual Dashboards: The user experience is tailored for both SMEs and investors. Borrowers can track funding status and repayments, while investors monitor ROI, diversification, and payment schedules via intuitive dashboards.

- Auto-Invest Functionality: Investors can enable auto-invest features based on defined criteria such as risk level, duration, or expected returns. This promotes passive investing and improves fund allocation speed.

- Escrow Account Integration: Funds are held in escrow accounts until conditions are met, ensuring transparency and compliance with Saudi Arabian Monetary Authority (SAMA) guidelines and investor protection protocols.

- Regulatory Reporting & Audit Trails: Lendo offers backend capabilities for generating compliance reports and maintaining detailed audit trails, which are essential for fintech governance.

- Customer Support Chatbot: Integrated support with chatbot and live agent escalation ensures user queries are resolved quickly, enhancing the overall experience.

Estimated Costs to Build Features for Lendo

| Feature | Description | Estimated Development Cost (SAR) |

| Invoice Financing Module | Core feature for invoice submission, vetting, and funding logic | SAR 93,750 – 150,000 (USD 25,000 – 40,000) |

| Dynamic Credit Scoring Engine | Proprietary AI/ML model for risk analysis and borrower rating | SAR 150,000 – 225,000 (USD 40,000 – 60,000) |

| Shariah-Compliant Architecture | Custom contract logic, non-interest financial models, and advisory integration | SAR 112,500 – 187,500 (USD 30,000 – 50,000) |

| Dual Dashboards (SMEs + Investors) | Separate UX for borrowers and investors, including funding, ROI,and payment tracking | SAR 131,250 – 206,250 (USD 35,000 – 55,000) |

| Auto-Invest Functionality | Custom rules engine for passive investment based on user preferences | SAR 75,000 – 131,250 (USD 20,000 – 35,000) |

| Escrow Account Integration | Third-party API integration with regulated escrow services and conditional logic | SAR 56,250 – 93,750 (USD 15,000 – 25,000) |

| Regulatory Reporting & Audit Logs | Backend admin tools to manage compliance reports and maintain detailed audit trails | SAR 75,000 – 112,500 (USD 20,000 – 30,000) |

| Customer Support Chatbot | AI-powered support with escalation to human agents | SAR 37,500 – 75,000 (USD 10,000 – 20,000) |

| Mobile App Development (iOS/Android) | Full-featured mobile app with same capabilities as the web platform | SAR 187,500 – 300,000 (USD 50,000 – 80,000) |

| Security & SAMA Compliance | Encryption, multi-factor authentication, and compliance with Saudi regulations | SAR 112,500 – 168,750 (USD 30,000 – 45,000) |

Comparison Table: Lendo vs Beehive vs Funding Circle

Below is a comparison table between Lendo, Beehive and Funding Circle that will help stakeholders compare business models, target markets, regulatory strengths, and returns. It will make it easier to assess the potential ROI of building a similar investment platform in the Saudi market.

| Feature / Platform | Lendo (KSA) | Beehive (UAE) | Funding Circle (UK/US) |

| Core Market | SMEs & Investors in Saudi Arabia | SMEs & Investors in UAE | SMEs & Investors in UK/US |

| Investment Model | Invoice Financing (Shariah-Compliant) | Peer-to-Peer Lending | Peer-to-Peer Lending |

| Returns Offered | ~10–15% annually | ~8–12% annually | ~6–9% annually |

| Regulation | SAMA Licensed, Shariah-Compliant | DFSA Regulated | FCA Regulated |

| Platform Features | Auto-Invest, Dual Dashboards, Escrow | Risk Grading, Auto-Invest | Risk Bands, Auto-Bid |

| Shariah Compliance | Yes | No | No |

| Mobile App Availability | iOS & Android | Web & Mobile | Web & Mobile |

How Much Does it Cost to Develop an Investment App Like Lendo?

The estimated cost to develop an investment app like Lendo in Saudi Arabia ranges between SAR 187,500 and SAR 937,500 (approximately $50,000 to $250,000). This estimate encompasses core functionalities such as user registration, loan listings, investment dashboards, and basic compliance features.

To estimate the development cost based on your specific requirements, use the following formula:

Total Development Cost = Hourly Rate × Development Time

Approximate Hourly Rates in Saudi Arabia:

- Junior Developers: SAR 100/hour (approx. $25/hour)

- Mid-Level Developers: SAR 115/hour (approx. $30/hour)

- Senior Developers: SAR 130/hour (approx. $35/hour)

- Specialized Experts: SAR 190/hour (approx. $50/hour)

Development Timeframe:

- MVP (Minimum Viable Product): 3–5 months

- Full-Featured App: 6–10 months

Note: These are average estimates; the actual cost to develop an investment app like Lendo may vary based on specific project requirements and complexities.

In the next section, we'll examine the multiple cost analyses that provide a clearer financial perspective on what to expect when building an investment app like Lendo.

Cost to Develop an Investment App Like Lendo by App Complexity

Building a financial software like Lendo requires clear planning, especially when it comes to budgeting. Below is an Arabic investment app cost breakdown based on app complexity:

| App Scope | Key Features | Estimated Cost (SAR) |

| MVP (Investor-only or Borrower-only Module) | Basic login, onboarding, loan listings, simple dashboard | SAR 187,500 – SAR 225,000 ($50,000–$60,000) |

| Mid-Level App | Dual user roles, automated loan workflows, and repayment tracking | SAR 262,500 – SAR 450,000 ($70,000–$120,000) |

| Full-Scale Lendo-Like Platform | AI-based credit scoring, compliance integrations, admin dashboard, investor management tools | SAR 525,000 – SAR 937,500 ($140,000–$250,000) |

Note: Actual cost depends on factors like choosing the right tech stack (native vs. cross-platform), team location (local or offshore), and engagement model (hourly vs. fixed). Always consult with a trusted development partner for precise estimation.

Cost to Develop an Investment App Like Lendo by Development Stages

Understanding the costs associated with each stage of app development helps you plan your budget effectively. Below is an Arabic investment app cost breakdown for building a Saudi investment app for each key development phase:

| Development Stage | Key Activities | Estimated Cost (SAR) |

| Discovery & Planning | Requirement gathering, market research | SAR 3,750 – SAR 18,750 ($1,000 – $5,000) |

| UI/UX Design | Wireframing, prototyping, Arabic/English localization | SAR 7,500 – SAR 30,000 ($2,000 – $8,000) |

| Frontend Development | Interface design using Flutter, React Native | SAR 18,750 – SAR 75,000 ($5,000 – $20,000) |

| Backend Development | APIs, databases, user authentication, server logic | SAR 22,500 – SAR 93,750 ($6,000 – $25,000) |

| Advanced Tech Integration | AI, blockchain, IoT integrations | SAR 30,000 – SAR 187,500+ ($8,000 – $50,000+) |

| Testing & QA | Manual/automated testing, bug fixes | SAR 7,500 – SAR 22,500 ($2,000 – $6,000) |

| Deployment | App store submission, compliance reviews | SAR 1,875 – SAR 7,500 ($500 – $2,000) |

| Compliance & Legal | SAMA licensing, KYC/AML compliance | SAR 11,250 – SAR 37,500 ($3,000 – $10,000) |

| Post-Launch Support | Maintenance, monitoring, and feature updates | SAR 3,750 – SAR 18,750/month ($1,000 – $5,000/month) |

Note: These investment app development costs are approximate and can vary depending on project specifics, technology choices, and team location.

[Also Read: How Much Does it Cost to Build a Digital Wallet App Like Payit?]

Factors That Influence the Cost to Develop an Investment App Like Lendo

The investment app development cost for a platform like Lendo depends on factors such as the feature set, security standards, and regulatory compliance. Costs also vary based on the app's complexity, third-party integrations, and whether it supports real-time financial data and analytics.

1. App Features

The range and sophistication of features significantly impact the overall cost to develop an investment app like Lendo. Basic functionalities such as investor onboarding, KYC/AML compliance, loan listing, and repayment tracking are standard.

However, integrating advanced features like AI-powered credit scoring, invoice financing, or blockchain-based escrow systems will increase development time, requiring specialized expertise and testing.

| Feature Complexity | Estimated Cost Range |

| Basic Features | SAR 37,500 – SAR 75,000 ($10,000 – $20,000) |

| Advanced Features (AI, Blockchain, Dynamic Scoring) | SAR 93,750 – SAR 187,500+ ($25,000 – $50,000+) |

2. User Roles & Dashboard Complexity

Lendo serves different personas: Investors, Borrowers, and Admins. Each requires a tailored user interface and backend logic. Investor and borrower dashboards need clear, real-time financial data and smooth navigation.

The admin panel demands more complex analytics, reporting, compliance monitoring, and user management features, often accounting for 20-30% of backend development costs.

| User Role | Cost Contribution | Estimated Cost Range |

| Investor Dashboard Feature Cost | UI/UX + Backend | SAR 18,750 – SAR 37,500 ($5,000 – $10,000) |

| Borrower Dashboard | UI/UX + Backend | SAR 18,750 – SAR 37,500 ($5,000 – $10,000) |

| Admin Panel | Analytics + Compliance Features | SAR 22,500 – SAR 56,250 ($6,000 – $15,000) |

3. Regulatory Compliance & Security

Compliance with financial laws is a major factor in the regulatory cost for Saudi fintech app like Lendo. Meeting KYC/AML protocols, SAMA guidelines, and data privacy mandates demands strong encryption, audit trails, secure logins, and regular compliance audits, adding significantly to both complexity and overall development cost.

| Compliance & Security Aspect | Description | Estimated Regulatory Cost for Saudi Fintech App Like Lendo |

| Licensing & Legal Consultation | Local regulatory compliance, legal advice | SAR 11,250 – SAR 22,500 ($3,000 – $6,000) |

| Security Implementations | Encryption, 2FA, secure payments | SAR 15,000 – SAR 30,000 ($4,000 – $8,000) |

| Ongoing Security Audits | Regular penetration tests, updates | SAR 7,500 – SAR 15,000 / year ($2,000 – $4,000 / year) |

4. UI/UX Design Complexity

A clean, intuitive user interface is critical for fintech apps, especially because users need to trust the platform and understand it easily. Using a simple design with reusable components (like buttons and forms) can help keep development costs lower. But if you want more advanced features, such as bilingual support or smooth animations, it’s better to hire experienced UI/UX designers. They can create a better user experience without making the app overly complex or expensive to scale later.

| Design Complexity | Description | Estimated Investment App Development Cost |

| Basic UI/UX | Standard templates, minimal animations | SAR 7,500 – SAR 15,000 ($2,000 – $4,000) |

| Advanced UI/UX | Custom design, animations, localization | SAR 22,500 – SAR 30,000 ($6,000 – $8,000) |

5. Technology Stack & Third-Party Integrations

Choosing native vs cross-platform development, cloud hosting, and third-party APIs (for payments, credit scoring, notifications) influences both upfront investment app development costs and ongoing operational expenses. Cross-platform frameworks like Flutter reduce costs but require optimization efforts.

| Technology Aspect | Description | Estimated Cost Range |

| Basic Tech Stack | Cross-platform, open-source backend | SAR 18,750 – SAR 37,500 ($5,000 – $10,000) |

| Advanced Tech Stack | Native apps, AI, and blockchain integrations | SAR 75,000 – SAR 112,500 ($20,000 – $30,000) |

| Third-Party API Integrations | Payment gateways, credit bureaus, and SMS | SAR 7,500 – SAR 22,500 ($2,000 – $6,000) |

6. Development Team Location & Hiring Model

Hiring costs vary widely based on geography and engagement model. Local fintech developers or in-house teams in Saudi Arabia offer greater control but at a higher price. Outsourcing offshore can reduce budgets significantly, though it may demand more oversight. It's important to balance these trade-offs when evaluating Lendo-like app features and development costs in KSA.

| Hiring Model | Location / Model | Estimated Cost Range |

| In-House | Saudi Arabia / US / Western Europe | SAR 450,000 – SAR 700,000 ($120,000 – $187,000) |

| Outsourcing | India / Southeast Asia / Eastern Europe | SAR 187,500 – SAR 375,000 ($50,000 – $100,000) |

7. Post-Launch Support & Maintenance

Ongoing investment app development costs, such as monitoring, bug fixes, security patches, feature updates, and customer support, are crucial for maintaining compliance and user satisfaction. These recurring expenses should be factored into the Lendo-like app features and development cost in KSA to ensure long-term platform stability and performance.

| Post-Launch Service | Description | Estimated Monthly Cost |

| Maintenance & Bug Fixes | Regular updates, performance optimization | SAR 3,750 – SAR 7,500 ($1,000 – $2,000) |

| Feature Enhancements | New functionalities, UI improvements | SAR 7,500 – SAR 11,250 ($2,000 – $3,000) |

| Customer Support | Technical support, helpdesk | SAR 3,750 – SAR 7,500 ($1,000 – $2,000) |

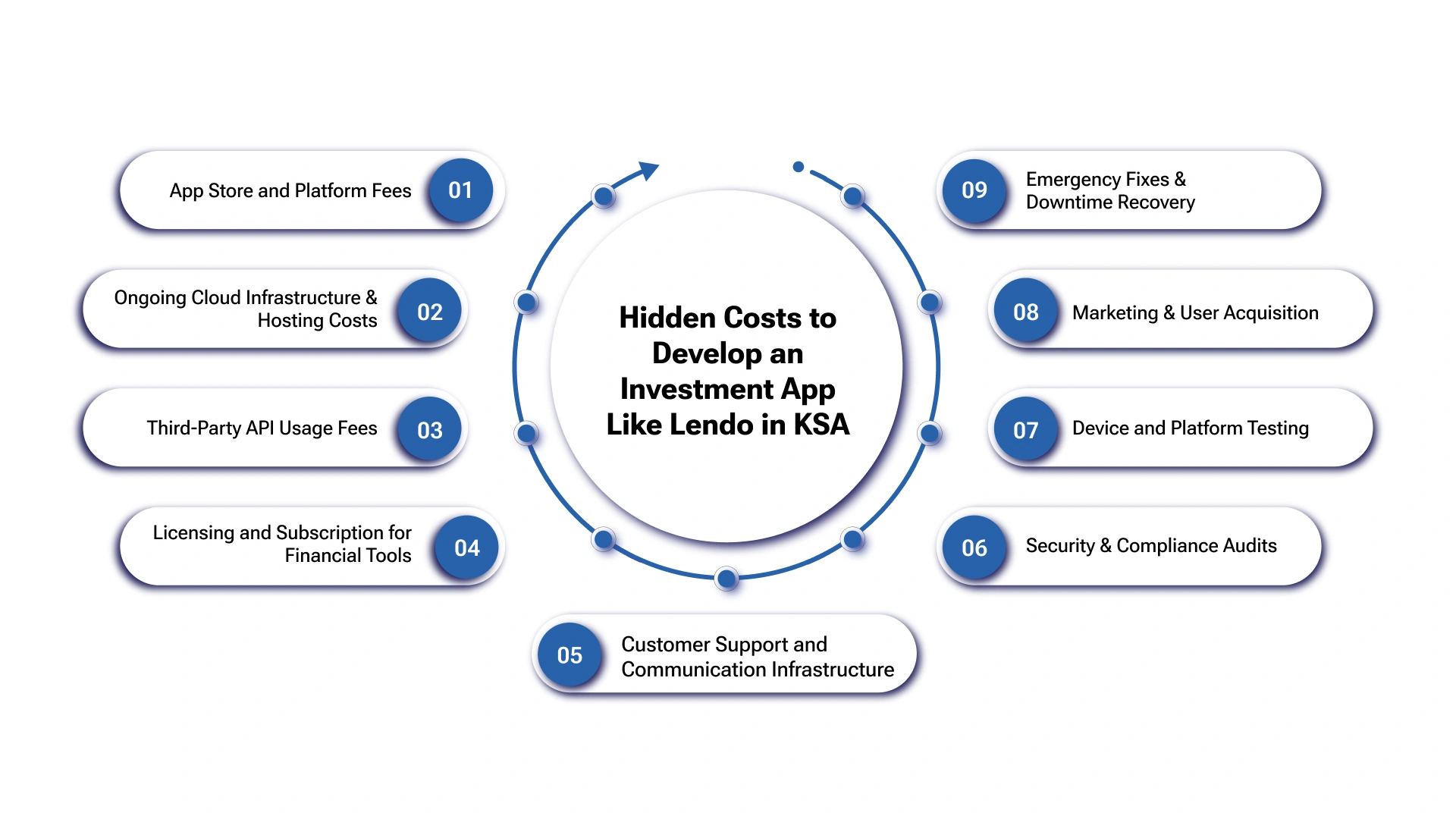

Hidden Costs to Develop an Investment App Like Lendo in KSA

Building a fintech investment platform like Lendo involves many costs beyond initial development. While some expenses are apparent, several hidden factors can significantly impact your crowdfunding app development cost in Riyadh and should be carefully considered during the planning stage to avoid budget overruns.

Key hidden Sharia-compliant investment app development cost factors include:

App Store and Platform Fees

Apple and Google charge developer fees and typically take 15–30% of transactions or in-app purchases. These fees reduce your revenue and should be included in long-term financial models.

Ongoing Cloud Infrastructure & Hosting Costs

Secure, scalable cloud hosting services via AWS, Azure, or Google Cloud are essential for real-time financial data and transaction processing. Monthly fees increase with user growth, data storage, and traffic.

Third-Party API Usage Fees

APIs for payment processing, KYC/AML verification, credit scoring, and messaging often come with subscription or usage-based fees. These charges can significantly increase over time, making it essential to factor them into your custom fintech app development cost estimate from the outset.

Licensing and Subscription for Financial Tools

Advanced analytics platforms, risk assessment engines, and security tools often come with recurring license fees, which contribute to the overall investment app development cost and should be included in long-term financial planning.

Customer Support and Communication Infrastructure

Maintaining 24x7 support with software like Zendesk and dedicated support staff enhances user satisfaction but also increases recurring operational expenses. These support-related costs should be factored into the total crowdfunding app development cost in Riyadh to ensure accurate long-term budgeting.

Security & Compliance Audits

Regular penetration testing, security audits, and certification expenses are required to protect sensitive financial data and comply with regulations like those of SAMA. These are critical but often underestimated crowdfunding app development cost in Riyadh.

Device and Platform Testing

Ensuring smooth performance across devices requires testing services like BrowserStack or Firebase Test Lab, which come with recurring subscription fees. These testing tools should be included in your stock trading app development cost to maintain cross-device compatibility and performance standards.

Marketing & User Acquisition

Marketing is often the largest hidden cost post-launch. Activities such as app store optimization, paid advertising, referral programs, and partnerships can consume 20–30% of your budget but are essential for driving user growth and engagement.

Emergency Fixes & Downtime Recovery

Unexpected bugs, crashes, or security breaches often demand immediate developer intervention, potentially disrupting operations and raising expenses. These unplanned events should be anticipated and factored into the stock trading app development cost to avoid budget overruns.

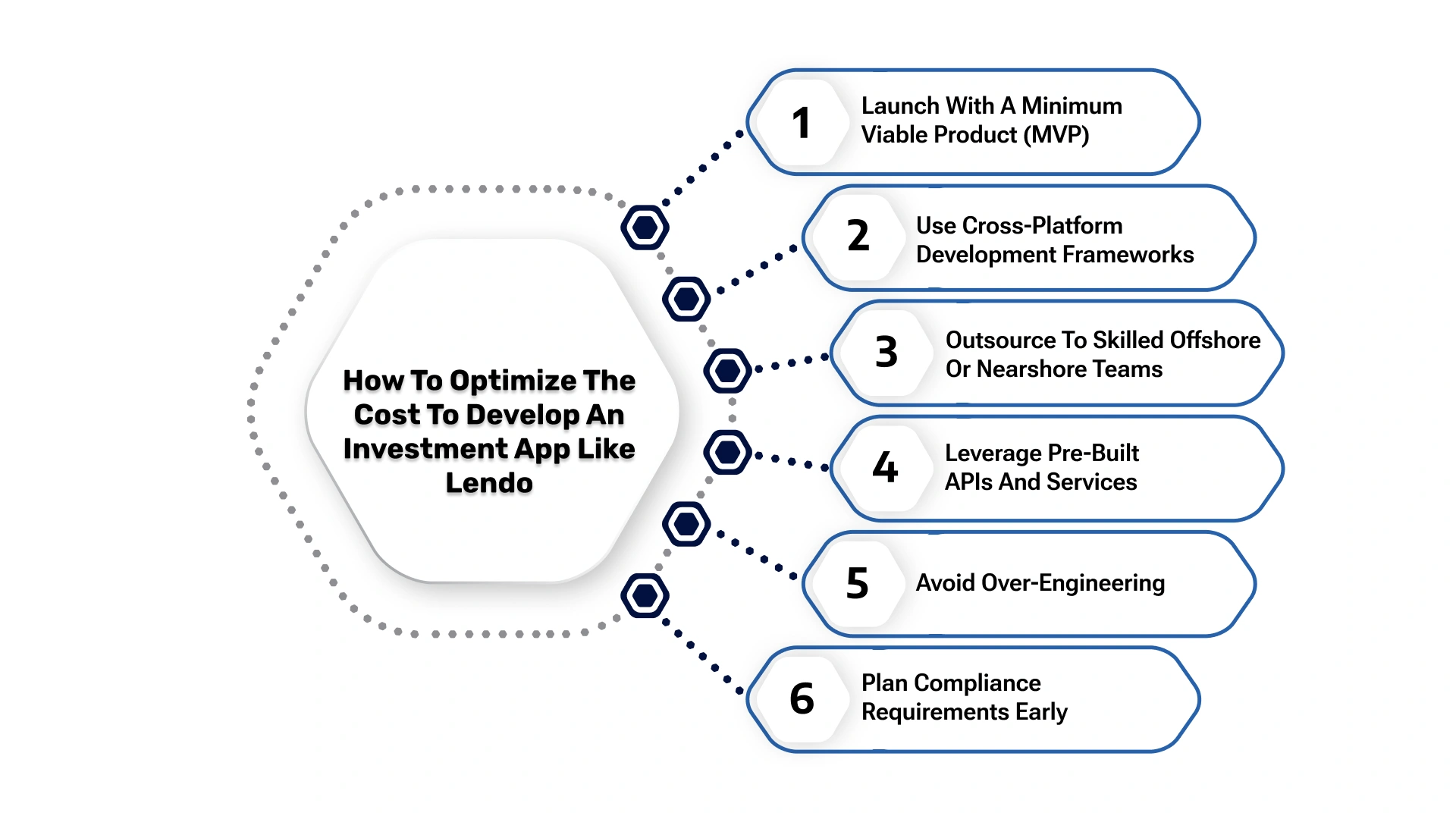

How to Optimize the Cost to Develop an Investment App Like Lendo

Developing a high-quality fintech platform like Lendo can be capital-intensive, but strategic planning can reduce Sharia-compliant investment app development costs without sacrificing quality or compliance:

1. Launch with a Minimum Viable Product (MVP)

Start with essential features like investor onboarding, KYC/AML verification, loan listings, and repayment tracking to reduce initial investment. This approach helps validate market demand while keeping the custom fintech app development cost estimate within a controlled range before scaling further.

2. Use Cross-Platform Development Frameworks

Technologies like Flutter or React Native enable simultaneous iOS and Android development from a single codebase, reducing development time and expenses significantly

3. Outsource to Skilled Offshore or Nearshore Teams

Partnering with the best fintech app developers in cost-efficient regions like India or Eastern Europe can significantly lower the investment platform app development cost for Saudi market, offering high-quality output at a fraction of local development rates.

4. Leverage Pre-Built APIs and Services

Integrate trusted third-party APIs for payments, credit scoring, and identity verification instead of building these complex features from scratch. This approach saves development time and ensures regulatory compliance.

5. Avoid Over-Engineering

Prioritize features that directly impact user experience and regulatory compliance. Avoid adding complex “nice-to-have” functionalities in the early stages that inflate costs unnecessarily.

6. Plan Compliance Requirements Early

Integrating regulatory and Shariah compliance from the design stage helps avoid expensive revisions and delays later. This proactive approach ensures your custom fintech app development cost estimate accurately reflects legal and operational requirements from the start.

AI & Automation in Investment Apps: Worth the Extra Cost?

Incorporating AI and automation into investment apps like Lendo offers tremendous benefits beyond traditional fintech features. These “smart” capabilities significantly enhance user experience, operational efficiency, and risk management, but inevitably increase development complexity and budget.

Key AI-powered features transforming investment platforms include:

- Predictive Risk Models: Using machine learning services to analyze borrower data and predict loan default risks improves investment decisions and portfolio health. This reduces non-performing loans and builds investor confidence.

- Auto-Invest Algorithms: AI can automatically allocate funds based on an investor’s risk profile, preferences, and market conditions, simplifying the investment process and increasing platform stickiness.

- AI-Driven Fraud Detection: Advanced pattern recognition helps detect suspicious activities in real-time, ensuring platform security and regulatory compliance.

- NLP-Based Customer Support Bots: Natural Language Processing chatbots provide instant, 24/7 assistance, reducing support costs and improving customer satisfaction.

Cost Impact:

Integrating AI and automation features can increase your overall Sharia-compliant investment app development cost by approximately 15–25%, depending on the complexity and depth of implementation. For instance, predictive models and fraud detection require data scientists, AI engineers, and rigorous testing, which are resource-intensive. However, the ROI through improved risk management and user engagement often justifies this investment.

Revenue Model: How Does an App Like Lendo Make Money?

Understanding how an investment app like Lendo earns revenue is crucial for justifying development costs and attracting investors. These platforms are more than tech builds—they’re structured financial businesses with scalable income streams.

Here are the most common monetization strategies used by invoice-financing and peer-to-peer investment apps:

1. Service Fees from Borrowers

Lendo charges a percentage-based fee for each successfully funded invoice. This is typically deducted upfront and can range from 1% to 5%, depending on the invoice amount and borrower risk profile. It becomes a recurring income stream as new invoices are continuously financed.

2. Investor Commission or Platform Fees

Platforms often take a small commission (0.5%–2%) on investor returns or deduct a flat fee per investment transaction. This ensures the platform earns as investors profit, aligning interests.

3. Premium User Plans

Investors may pay for premium features such as early access to funding rounds, higher funding limits, portfolio analytics, or auto-invest capabilities. Monthly or annual subscriptions create steady recurring revenue.

4. Late Payment Penalties & Risk Buffer Fees

Some platforms introduce penalties or margin fees on late repayments or higher-risk financing. These not only encourage borrower discipline but also enhance platform revenue.

5. White-Labeling and Licensing

In the long run, companies like Lendo can license their platform to other regional markets or financial institutions, opening B2B revenue streams. This model helps monetize IP and expand without direct borrower management.

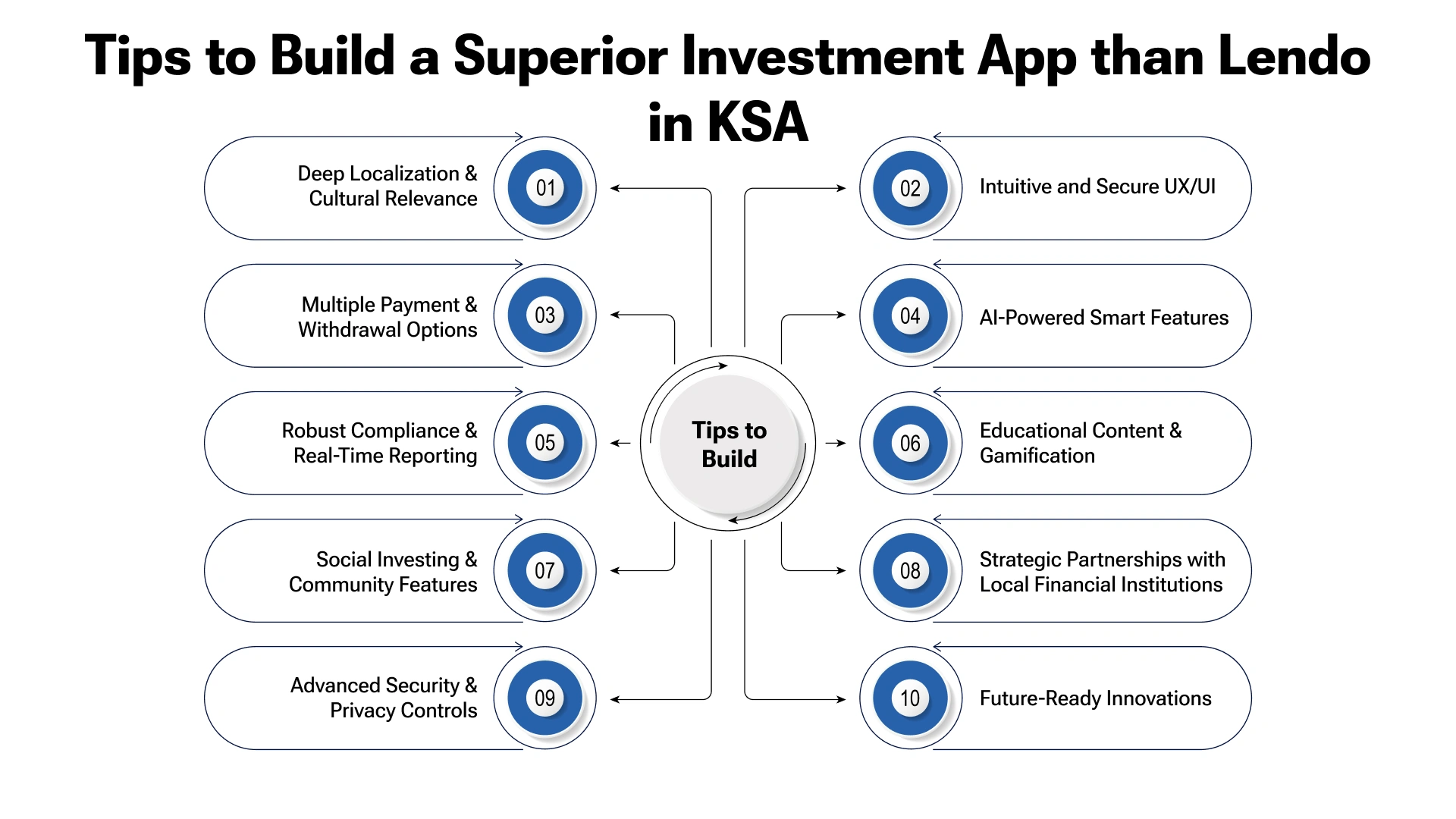

Tips to Build a Superior Investment App than Lendo in KSA

Saudi Arabia’s investment app market is growing rapidly, and while Lendo is a prominent player, you can create an app that truly stands out by focusing on local needs, advanced technology, and a seamless user experience.

Here’s how to build an investment app that outperforms Lendo:

Deep Localization & Cultural Relevance

Support the Arabic and English languages. Incorporate Sharia-compliant investment options and align with local financial regulations. Offer products linked to Saudi exchanges and government bonds to appeal to regional investors.

Design a clean, user-friendly interface with quick onboarding and real-time portfolio tracking. Include biometric security (Face ID, Touch ID) and easy navigation with personalized dashboards and alerts for enhanced user trust.

Integrate popular Saudi payment methods like STC Pay, Mada, and direct bank transfers. Enable recurring investments and flexible withdrawals to improve accessibility and user control over their funds.

Implement AI-driven investment recommendations, predictive risk modeling, fraud detection, and automated portfolio rebalancing. NLP-powered chatbots offer instant, bilingual support, creating a smarter and more responsive experience.

Ensure strict KYC/AML verification in line with SAMA regulations. Deliver real-time reports on returns, tax documents, and risk exposure to meet both investor expectations and regulatory standards.

Incorporate an in-app learning hub with tutorials, FAQs, and market updates. Add gamified elements like badges and rewards to encourage frequent use and deepen investor knowledge.

Allow users to share strategies, view leaderboards, and participate in discussion forums. These features help foster a sense of community and drive app engagement through peer influence.

Collaborate with Saudi banks and brokerage firms for seamless fund movement and exclusive offerings. These partnerships strengthen trust and enable broader financial integration for users.

Implement end-to-end encryption, 2FA, and conduct periodic security audits. These measures ensure that sensitive financial data remains protected against evolving cyber threats. Also, explore technologies like blockchain for smart contracts, robo-advisors, and digital identity tools. These innovations future-proof your platform and improve onboarding and operational efficiency.

Build a Powerful Investment App Like Lendo with VLink Expertise

VLink brings deep expertise in fintech product engineering, regulatory compliance, and scalable architecture design. We work closely with CXOs and digital teams to turn investment ideas into production-ready apps that meet financial, operational, and regulatory goals.

Why financial leaders choose VLink for building Lendo-style investment apps:

- Strategic Fintech Know-How

Our teams have delivered apps across the investment lifecycle, including fundraising, investor onboarding, portfolio management, and real-time reporting. We help you launch platforms that aren't just compliant, but competitive.

- Rapid Time-to-Value

We’ve helped fintech clients reduce time-to-launch by 30% using modular MVP kits, reusable compliance modules, and pre-integrated APIs built for the Saudi market’s CMA and SAMA regulations..So, hire fintech app developers and take your app success to the next level.

- Experience in Local & Global Compliance

Whether it’s Shariah certification, CMA sandbox alignment, or secure investor data handling, we build with compliance in mind—so you don’t have to retrofit it later.

- Investor-Centric UX with Built-In Scalability

From bilingual dashboards and RTL support to tiered onboarding for institutional and retail investors, we ensure your product works for real users—and grows with them.

- Full Lifecycle Delivery & Ownership

You don’t just get developers. You get a product partner that supports road mapping, builds with agility, delivers on milestones, and sticks around post-launch for iteration and scale

Partner with VLink today and let us help you create an innovative, secure, and user-friendly investment app that can compete with and surpass Lendo in the market.

Shivisha Patel

Shivisha Patel